RBC Client First

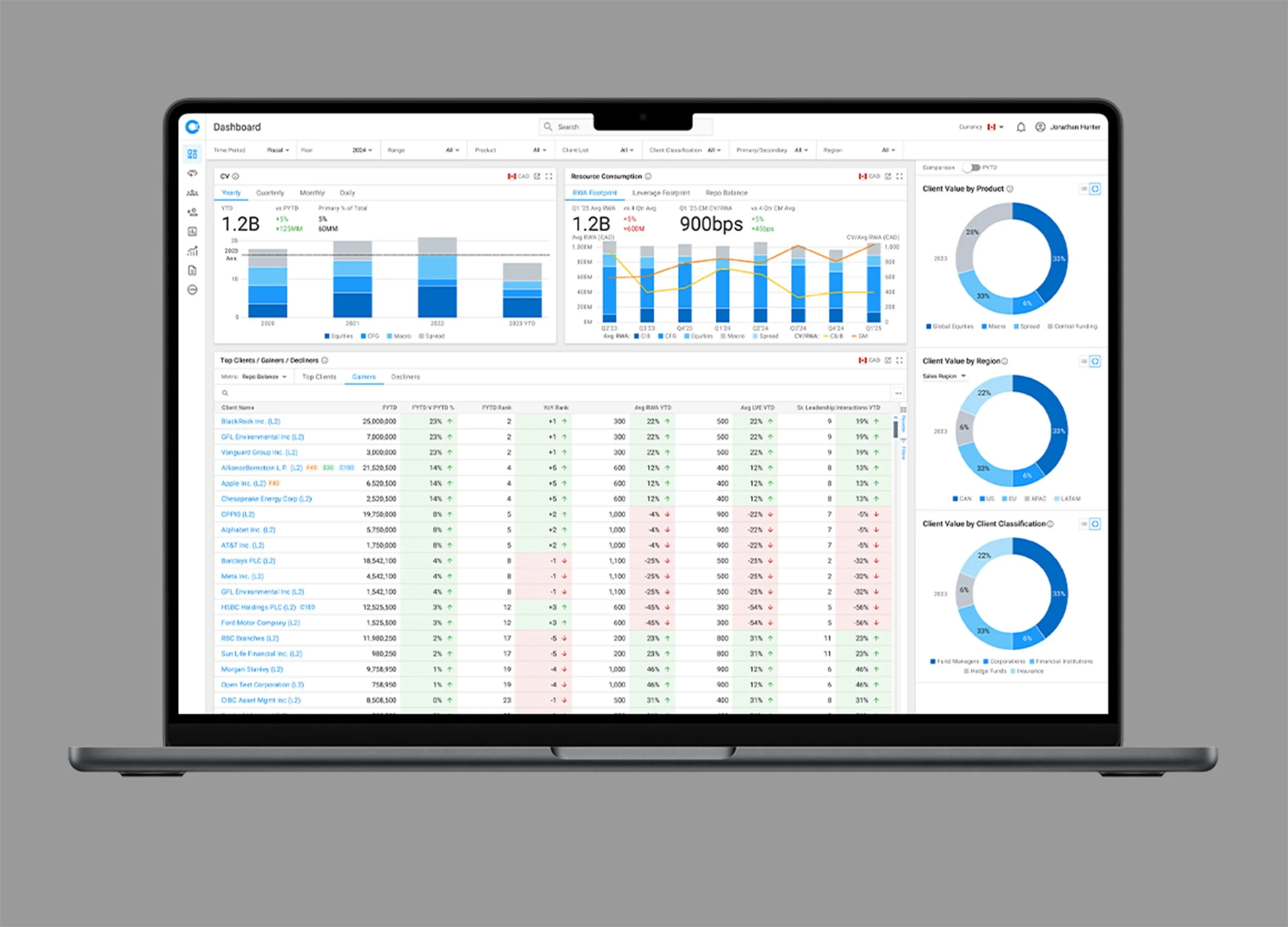

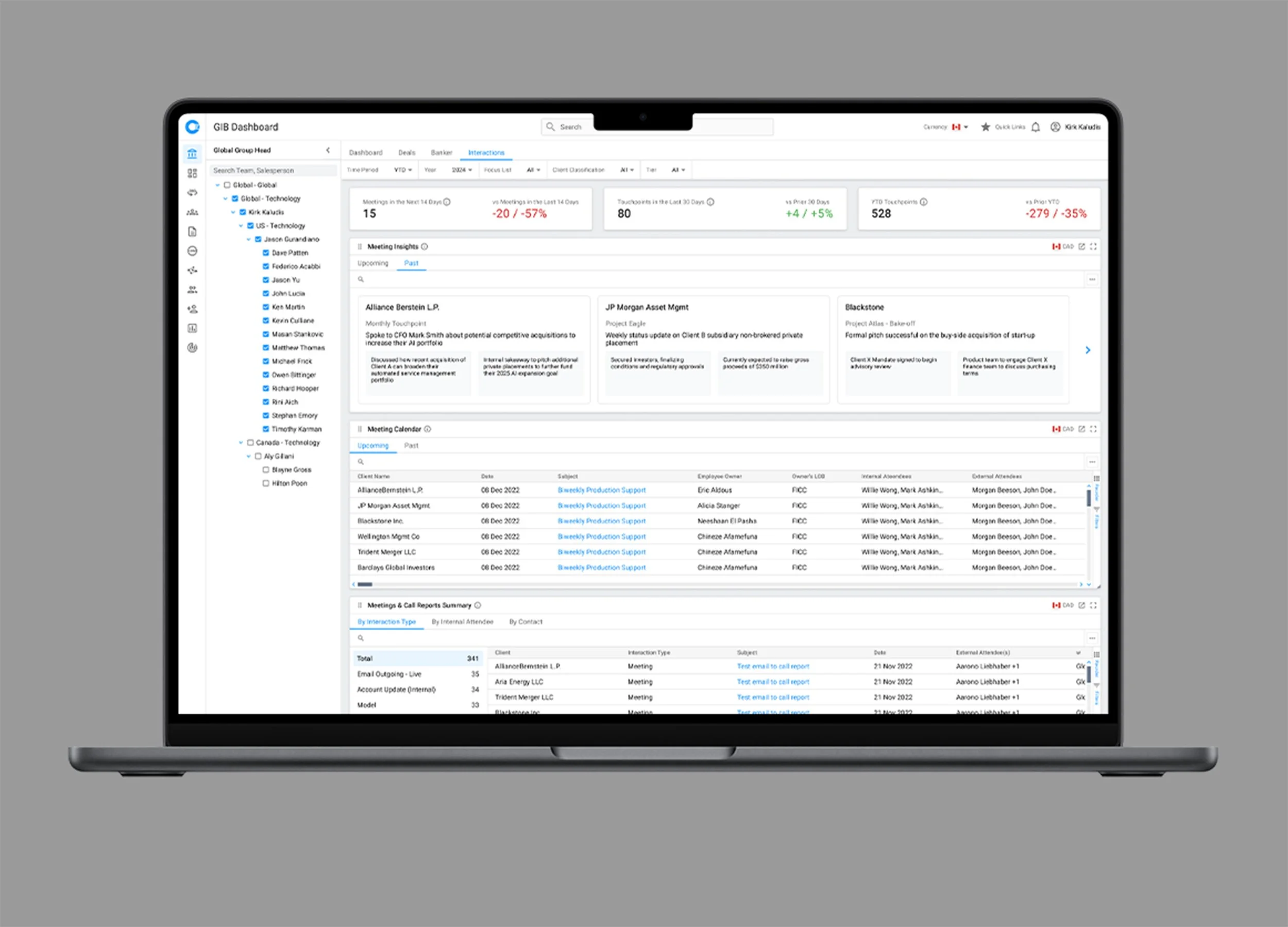

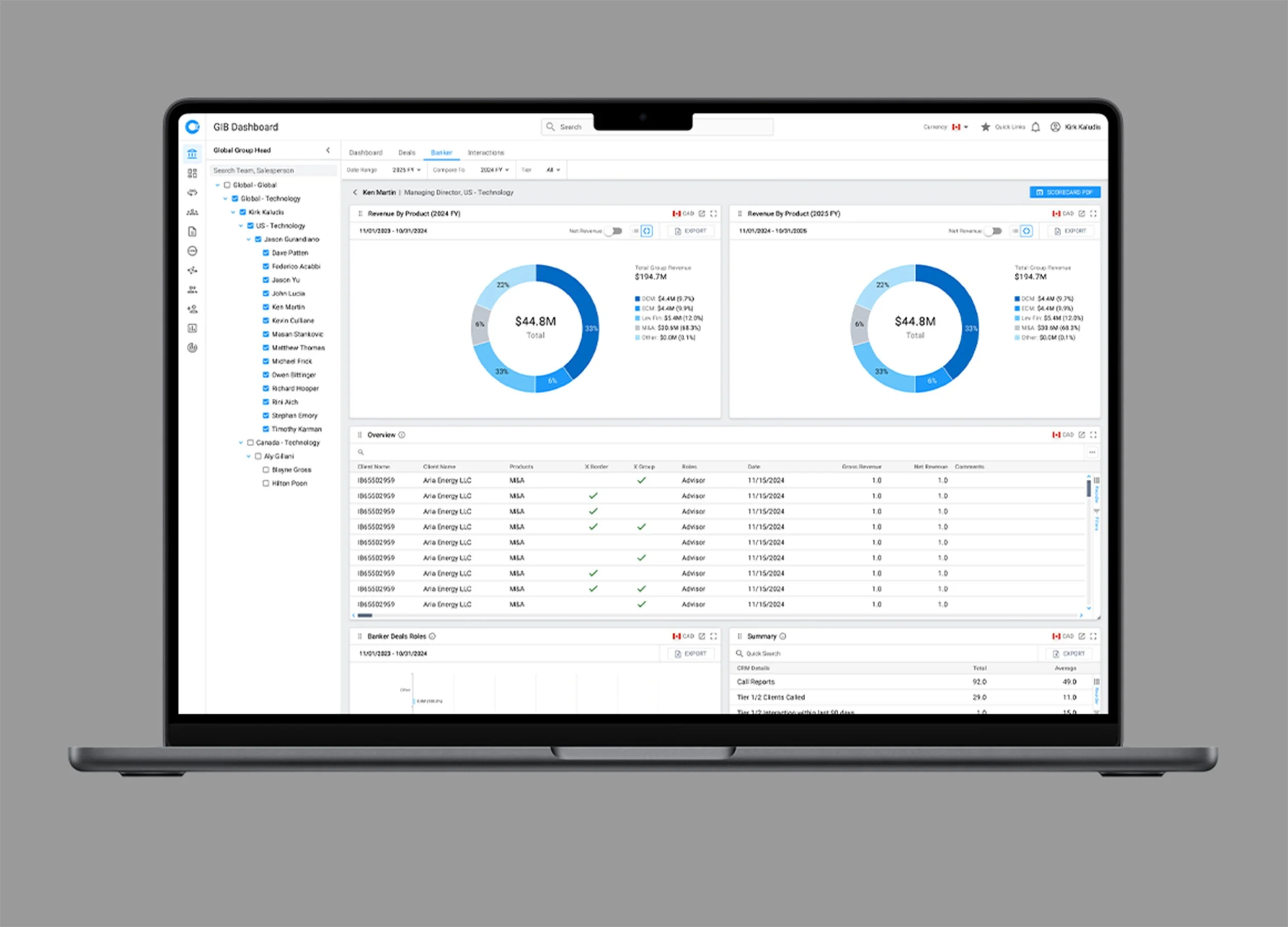

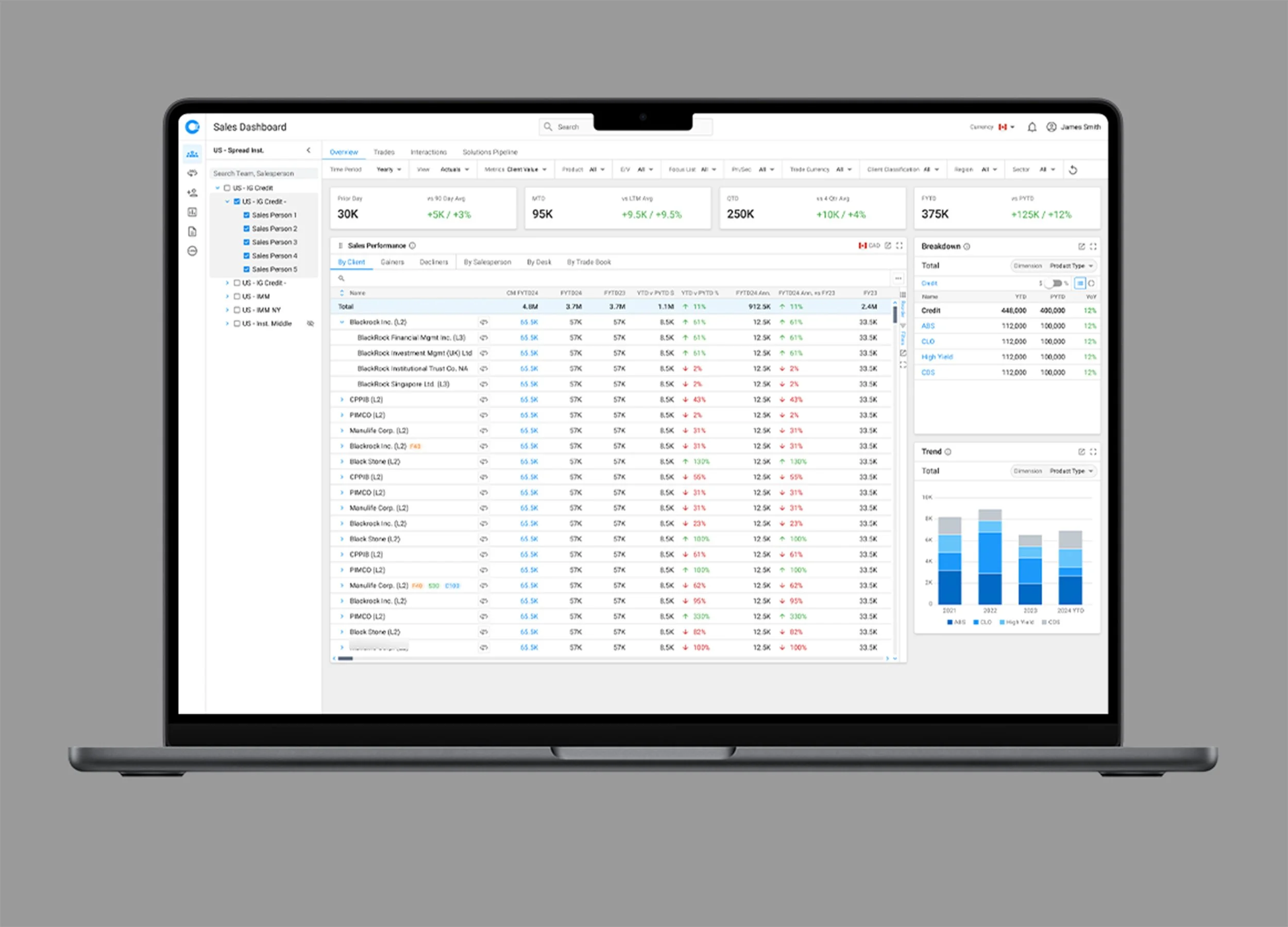

Client First was a large-scale transformative initiative to consolidate and modernize over 20+ legacy tools used by investment bankers, sales teams, and group heads for analyzing client data and performance. The goal was to provide a unified platform where users could seamlessly access client performance data, and that streamlined workflows, improved decision-making, and supported the firm’s long-term digital transformation strategy.

As the lead designer, I worked with a diverse set of stakeholders — from executive sponsors to front-line bankers — to align on core business priorities while addressing pain points in daily workflows. I partnered closely with product managers and engineering teams to:

Consolidate overlapping tools into a single, intuitive platform.

Standardize data visualization and reporting to enable faster, more accurate decision-making.

Define scalable interaction patterns to support future expansion beyond the initial scope.

Impact:

Successfully migrated 20+ fragmented tools into a single modernized platform.

Significantly improved usability and adoption, with bankers and salespeople citing faster access to insights.

The platform’s success drove organic demand from additional teams, who requested to migrate their day-to-day operations into Client First — expanding its influence across the organization.

Prior to Client First, bankers and salespeople were forced to rely on more than 20 disparate and often outdated tools to analyze client performance. Workflows were inefficient and inconsistent, requiring users to toggle across systems and manually stitch together data. The lack of standardization created errors, slowed decision-making, and frustrated users. Beyond the operational challenges, the firm wanted a solution that could not only streamline current workflows but also serve as a foundation for long-term digital transformation.

problem.

I facilitated workshops with stakeholders ranging from front-line bankers to executive sponsors. These sessions helped uncover how fragmented tools impacted daily workflows and revealed the business priorities behind the modernization effort. I conducted interviews with bankers and sales leads to capture real user needs, while auditing legacy systems to identify redundancies and prioritize the highest-value features for migration.

research.

strategy.

Working closely with product managers, I helped define the strategic principles for the platform: consolidation, scalability, and usability. Together we aligned with leadership on measurable business outcomes such as adoption, efficiency gains, and standardized reporting. From there, we created a phased roadmap that allowed us to deliver high-impact features early, while leaving room for additional teams to migrate onto the platform over time.

design.

I developed the information architecture to unify disparate data sources into a cohesive experience. I created standardized dashboards and reporting views that enabled bankers and leaders to access insights quickly and accurately. To support long-term growth, I designed scalable interaction patterns and a design system that could evolve as new teams and workflows were added. Throughout the process, I tested prototypes with bankers and salespeople, iterating based on usability feedback to ensure the final product met both user and business needs.

The final product was a modern, intuitive analytics platform that consolidated more than 20 legacy tools into one cohesive experience. Bankers, sales teams, and leadership gained role-based dashboards that provided faster access to relevant insights and streamlined reporting. Standardized data visualization and interaction patterns not only improved usability but also established a foundation for scalability as new workflows were added. The platform was intentionally designed to serve as the firm’s central hub for client analytics, positioning it as a cornerstone of future digital transformation.

Reduced request turnaround times by eliminating manual steps and incomplete submissions.

Increased transparency for bankers and clients through real-time request tracking.

Improved approval efficiency, enabling internal teams to process higher volumes with fewer errors.

Established a scalable foundation for future workflows to be added into Springboard.