RBC Client Lifecycle Management - Client Portal

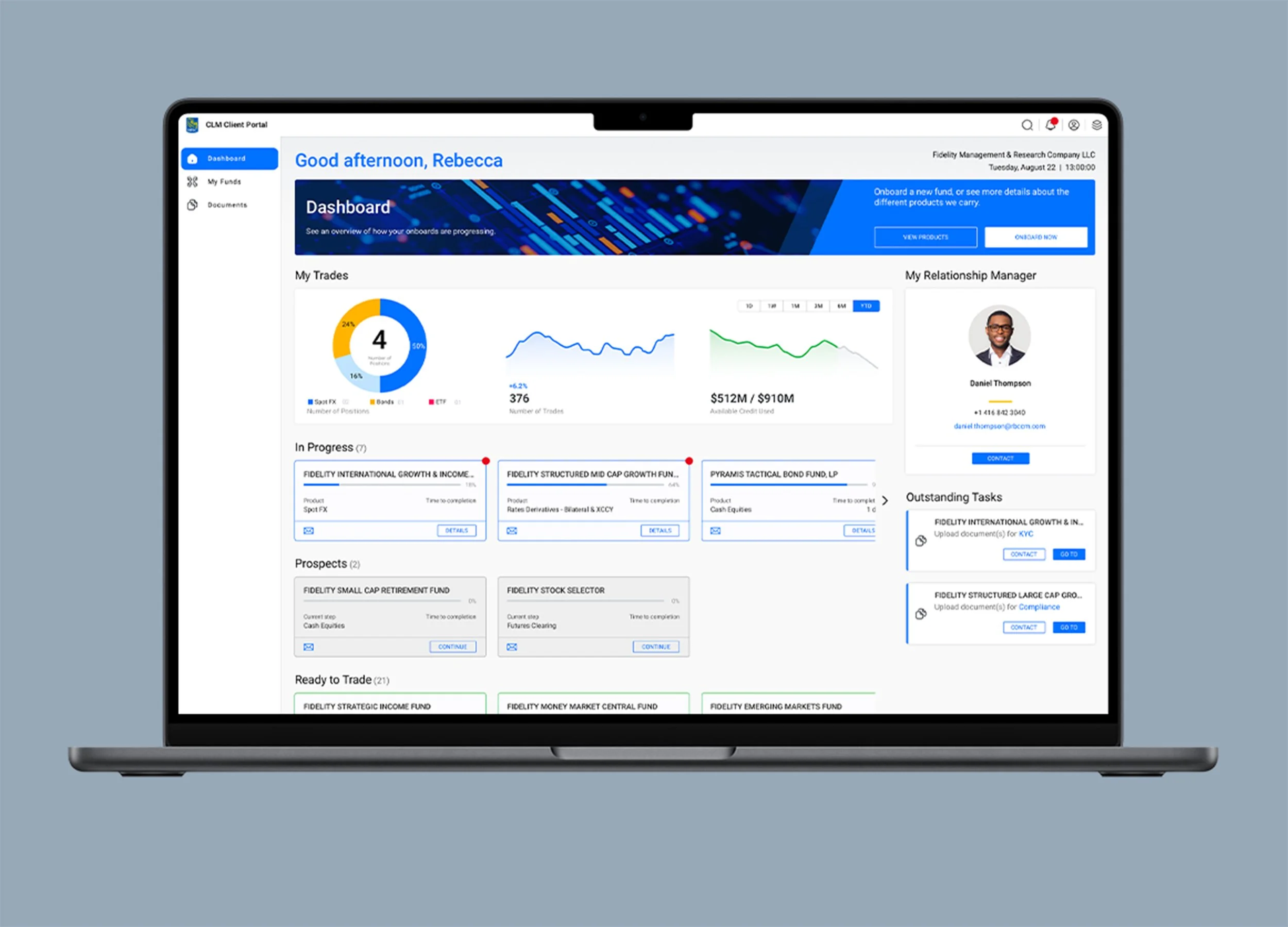

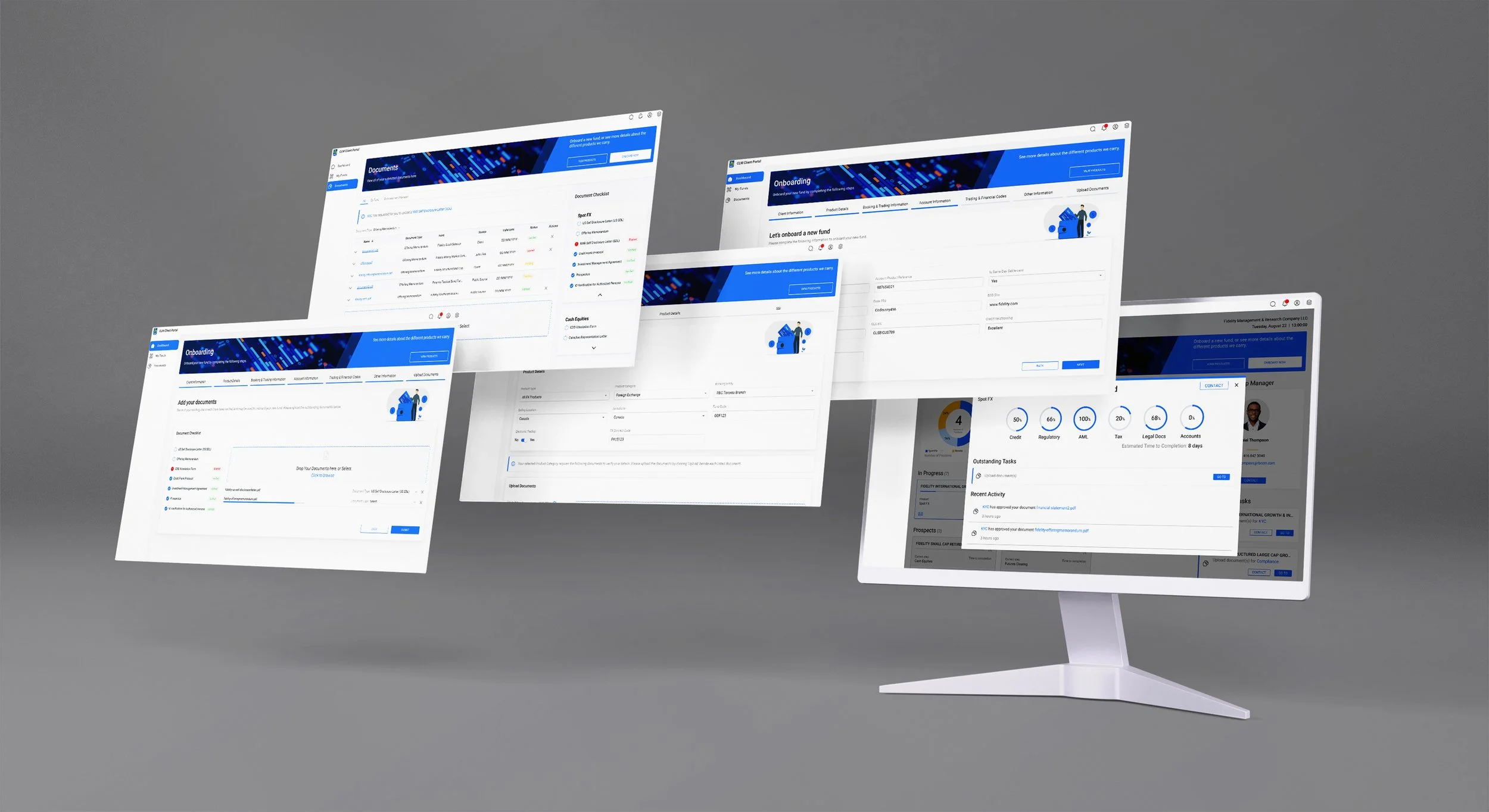

The RBC Client Lifecycle Management (CLM) was a new tool designed and built for investment bankers and sales people, streamlining the end-to-end process of managing client relationships. The Client Portal is the clients’ (company/corporation representatives) way to respond and efficiently manage their onboarding status and progress.

Our UX approach emphasized simplifying complex workflows, ensuring regulatory compliance, and providing clients with intuitive tools to organize onboarding information, track progress, and reduce operational friction. The result is a portal that improves productivity and enhances transparency for bankers and clients at RBC.

Clients onboarding with the bank faced a lack of transparency and an overly complex documentation process. They often had to rely on back-and-forth emails, phone calls, or fragmented portals to understand what was required, leading to frustration, delays, and incomplete submissions.

problem.

To better understand the client perspective, I reviewed existing onboarding materials, observed banker–client interactions, and analyzed feedback. Key findings included:

Clients had little visibility into where they stood in the onboarding process.

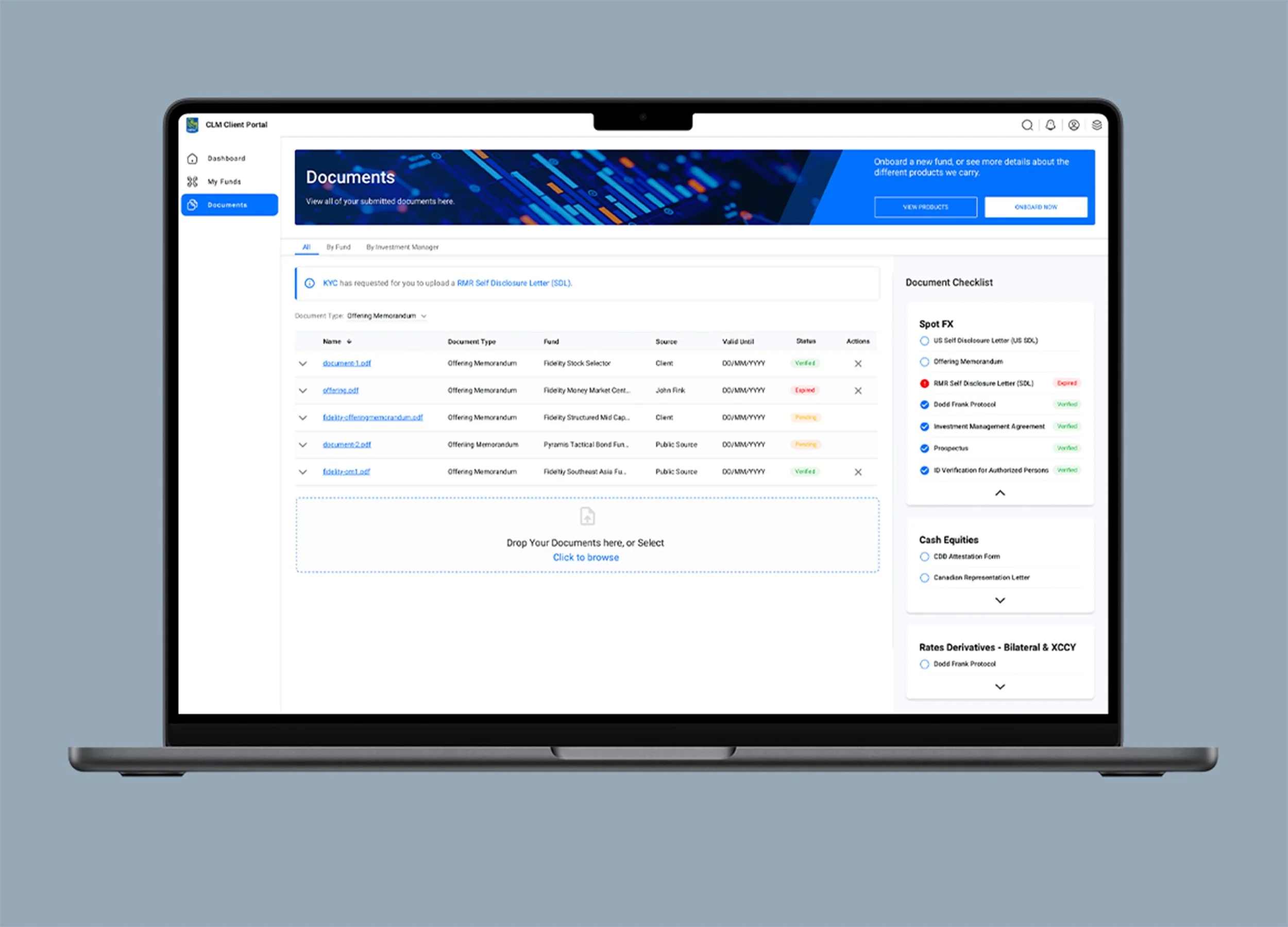

Documentation requests were unclear and often repeated.

Clients needed a secure and simple way to upload documents and complete forms online.

The tone and experience needed to feel approachable, not overwhelming.

research.

design.

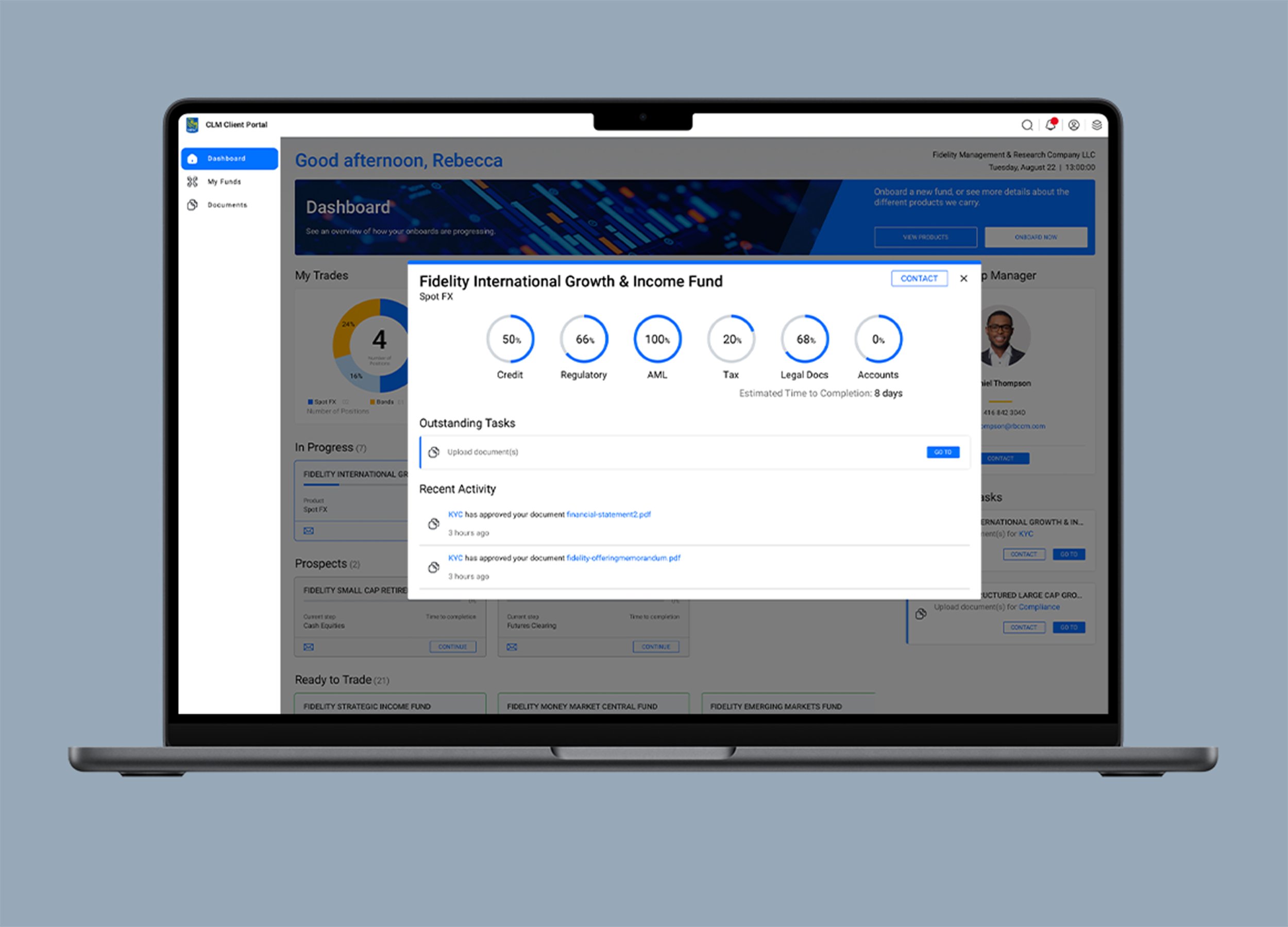

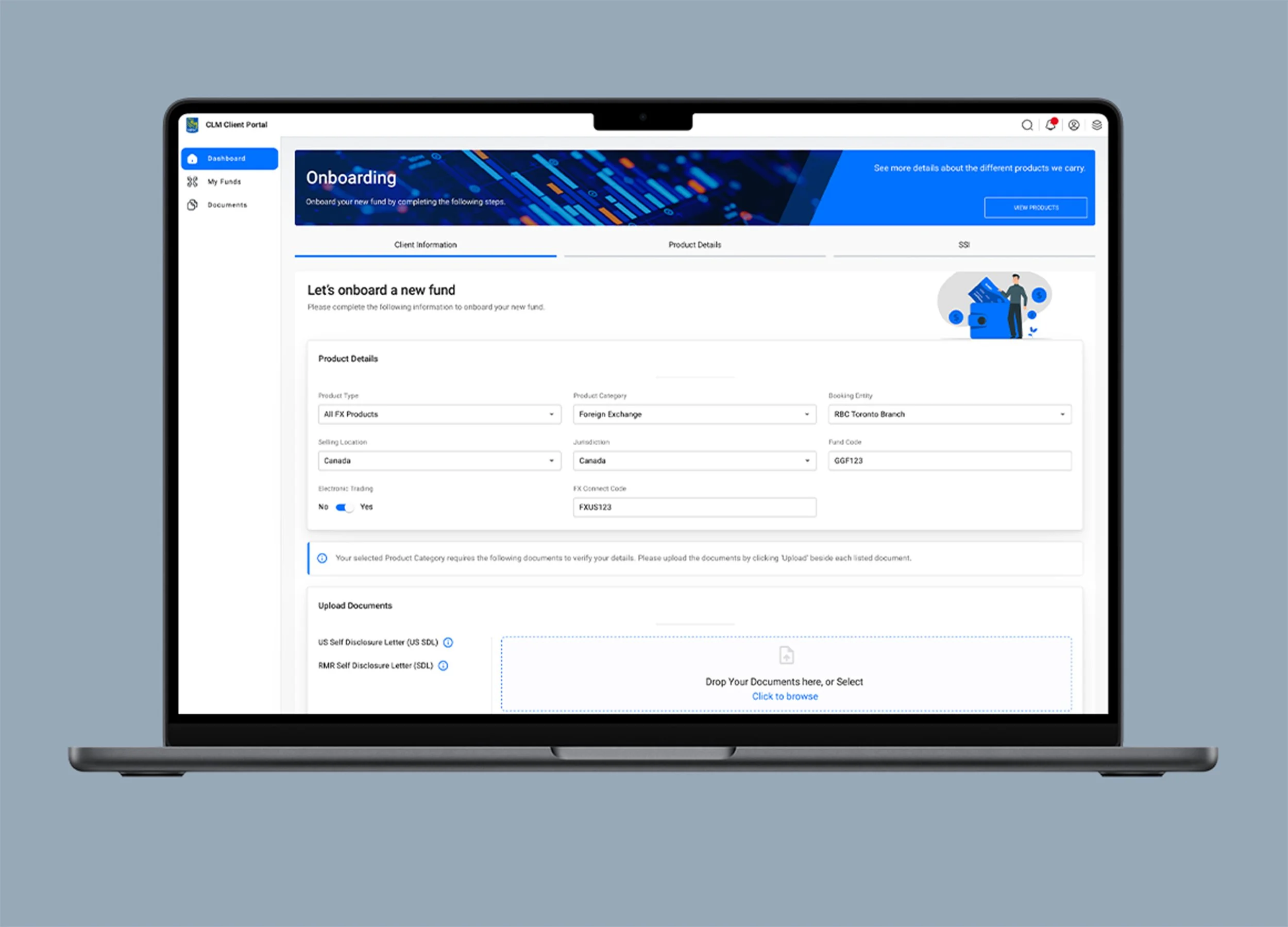

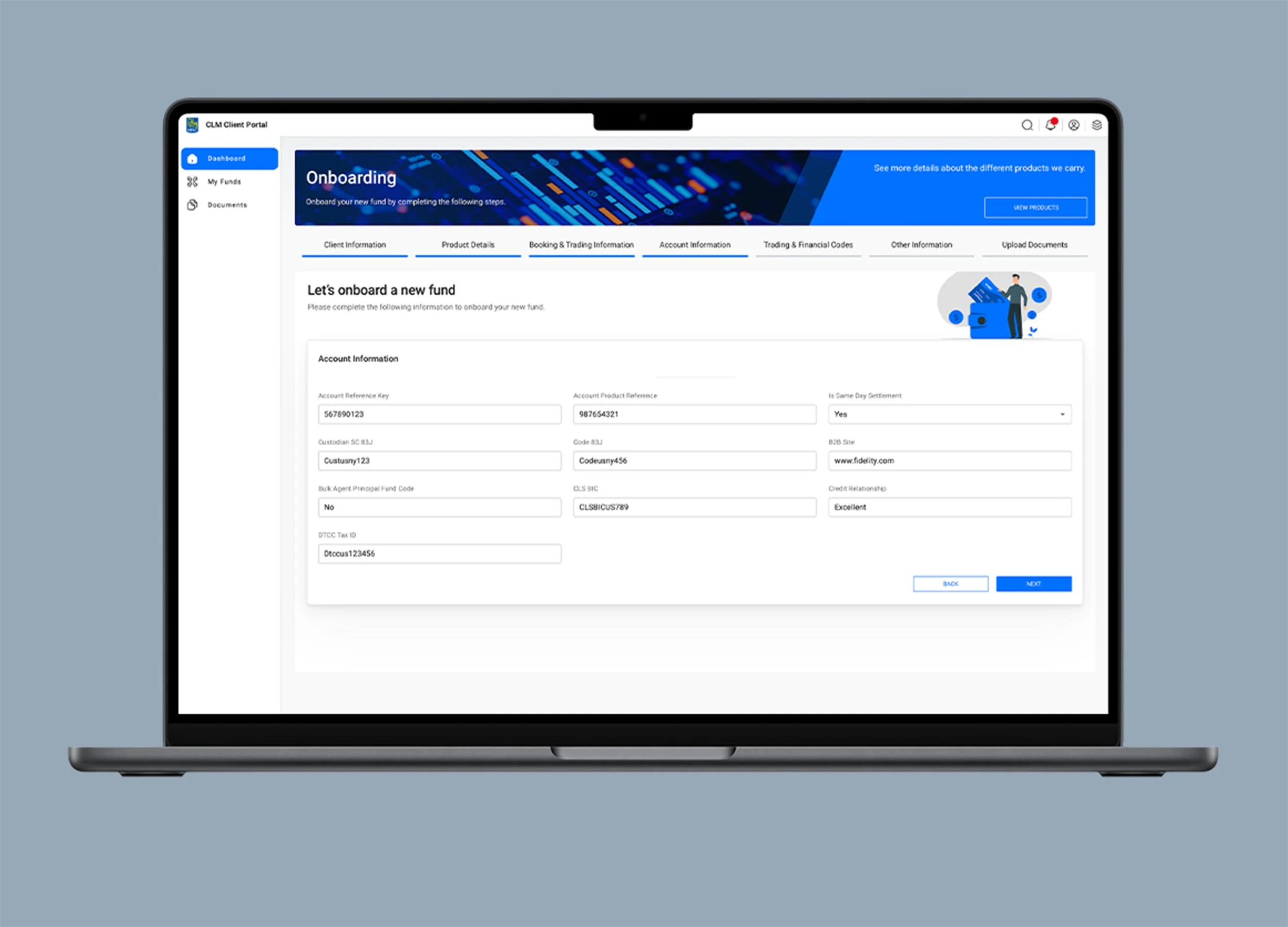

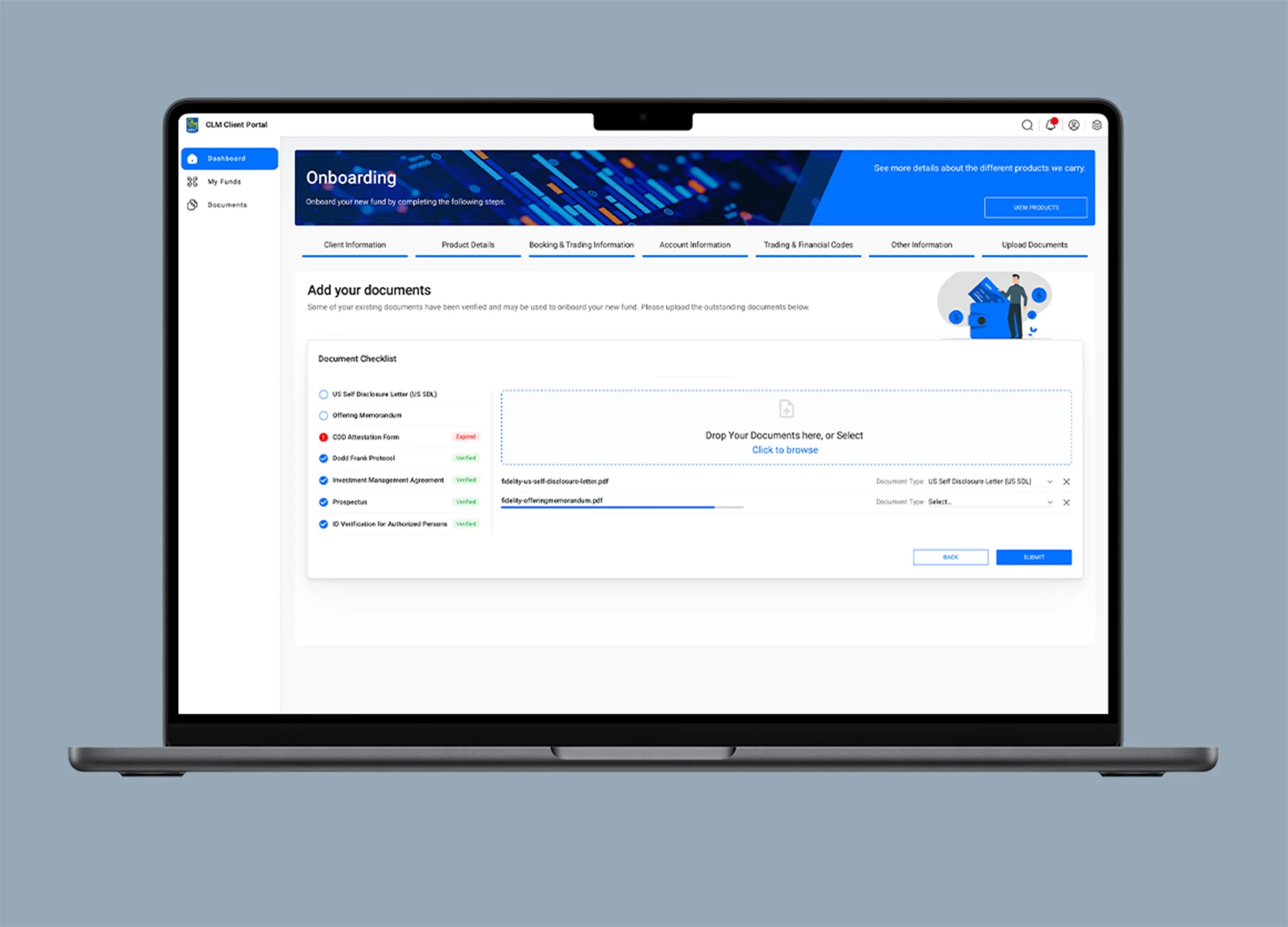

The goal was to create a transparent, self-service portal where clients could easily see progress, take action, and securely complete onboarding requirements. Key design solutions were:

Progress tracker that visualizes each stage of onboarding and current status.

Action-oriented dashboard highlighting outstanding tasks, forms, or documents.

Guided form completion with contextual help to reduce confusion.

Secure document upload with drag-and-drop functionality.

Responsive, clean interface designed to be accessible across devices.

outcome.

The Client Portal empowered clients with clarity and control over their onboarding experience. By reducing uncertainty and streamlining documentation, the portal shortened onboarding timelines, improved accuracy of submissions, and created a more positive first impression of the bank. Clients reported feeling informed, confident, and supported, while bankers benefited from faster turnaround and fewer manual follow-ups.